In keeping with my 2021 resolutions to a) stop procrastinating and b) simplify my life in order to make “a)” a possibility, I’ve decided that this is the year I won’t be scrambling to do my taxes! The best part? You can benefit from my newfound proactiveness: read on for a review of TurboTax Live Full Service, a simple and affordable way to have your taxes done by a real tax expert – without leaving the comfort of your home!

There’s no doubt it’s more important than ever to file correctly and get every dollar we deserve. However, finding work/ life balance in COVID times is also a challenge; both my kids have been learning from home for almost a year, and in between being a parent, entrepreneur, photographer, at-home chef, armchair therapist… sigh, the list goes on!… I don’t necessarily have the time or energy to prepare my own taxes. My main goal heading into this tax season was to obtain the largest possible tax refund while staying safe at home.

There’s no doubt it’s more important than ever to file correctly and get every dollar we deserve. However, finding work/ life balance in COVID times is also a challenge; both my kids have been learning from home for almost a year, and in between being a parent, entrepreneur, photographer, at-home chef, armchair therapist… sigh, the list goes on!… I don’t necessarily have the time or energy to prepare my own taxes. My main goal heading into this tax season was to obtain the largest possible tax refund while staying safe at home.

Enter TurboTax Live Full Service – an online tax service which allowed me to easily hand off my taxes to an expert.

The cost is $129.99, which does not change – no matter how complicated your tax situation is.

The cost is $129.99, which does not change – no matter how complicated your tax situation is.

From a cost/ benefit standpoint, I declare it a win: in addition to having your taxes filed for you without leaving your home, you also have access to a tax expert with more than 10 years of experience. This dedicated tax representative is able to answer any questions you may have during the process, and with a 100% accuracy and maximum refund guarantee, you have peace of mind knowing that your taxes will be done right, with your best interests in mind.

Filing your taxes with TurboTax Live Full Service is as simple as 1, 2, 3:

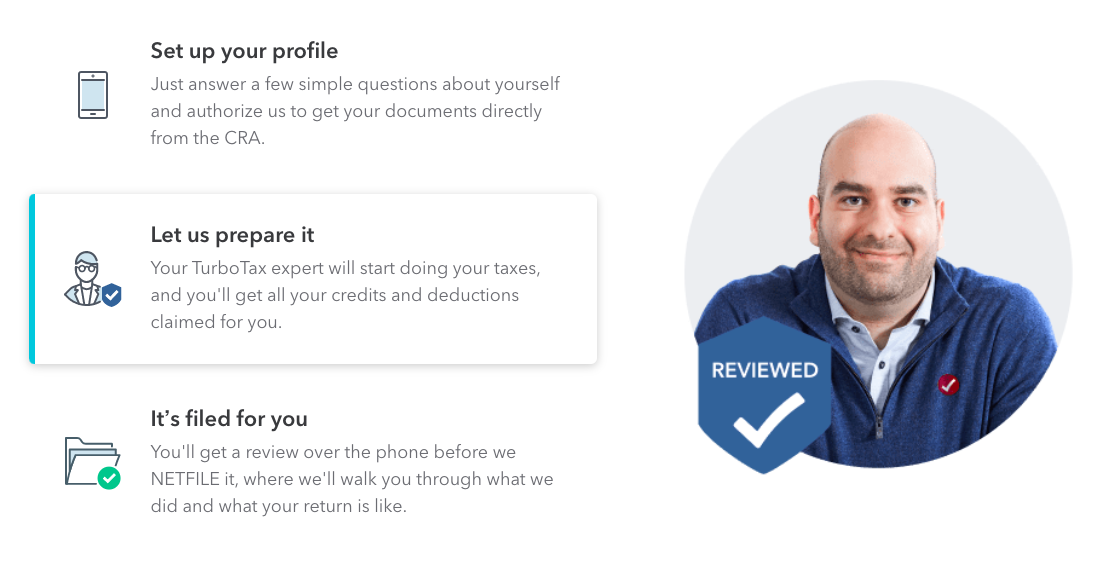

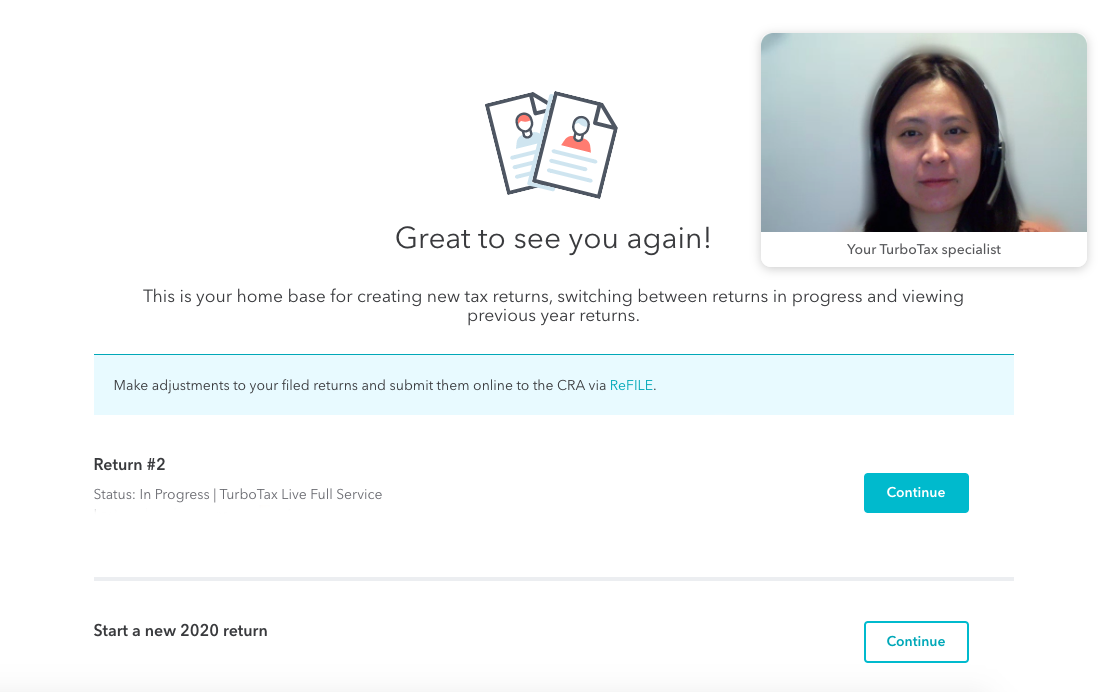

1. Set up your profile. Super simple and easy to do! Visit the TurboTax Live Full Service website or use the mobile app and either log-in or create an account. You’ll just need to fill out some basic information about yourself and sign an online agreement to authorize TurboTax as your representative with the CRA. One of the main benefits is that your tax expert will be able to grab your tax slips directly from the CRA, so you don’t have to collect or organize them. If you do have tax documents to share, you can upload them securely to the website.

1. Set up your profile. Super simple and easy to do! Visit the TurboTax Live Full Service website or use the mobile app and either log-in or create an account. You’ll just need to fill out some basic information about yourself and sign an online agreement to authorize TurboTax as your representative with the CRA. One of the main benefits is that your tax expert will be able to grab your tax slips directly from the CRA, so you don’t have to collect or organize them. If you do have tax documents to share, you can upload them securely to the website.

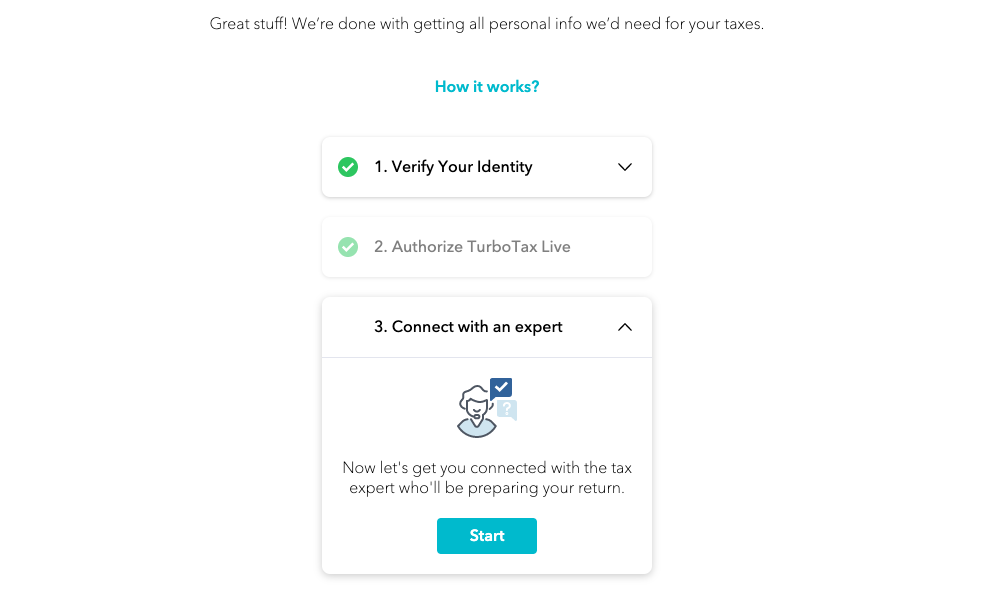

Once you’ve set up your profile and authorized TurboTax Live, it’s time to connect with an expert. The earliest I was able to schedule a call was 48 hours later, and as the wait time may increase as the tax deadline approaches, it’s important to plan ahead accordingly.

Once you’ve set up your profile and authorized TurboTax Live, it’s time to connect with an expert. The earliest I was able to schedule a call was 48 hours later, and as the wait time may increase as the tax deadline approaches, it’s important to plan ahead accordingly.

My discovery call with the TurboTax expert was quick and efficient; in less than 10 minutes, she collected some necessary personal information, and from there, the remainder of our communication (up until the final review) took place over online chat (more below).

2. Let TurboTax prepare your taxes. This is essentially where you’ll hand things off to your tax expert. While they go through your documents, you’ll need to stay on top of the following tabs:

Next Steps. Consider this your notification tab; you’ll receive information here about what happens – you guessed it – next, in an effort to keep you informed about the process.

Documents. Here’s where you will download/upload any documents needed for identification, signature, or supplementary info related to your tax return.

Tax Experts. This is your online chat, and where the bulk of your correspondence will take place. Feel free to ask your tax expert as many questions as you’d like! The best part: you can access your expert from anywhere – even from the comfort of your couch. When a new message is waiting, you’ll receive an email notification.

3. It’s filed for you. (But just before they do, review.) Included in TurboTax Live Full Service is a full walk-through with your tax expert. This can be arranged through a phone call or one-way video conference, where the expert will go over their calculations, answer any questions you may have, provide a detailed breakdown of every deduction and credit you’re eligible for, and provide tips for future returns. Once everything looks right to you, you will give your tax expert permission to sign and file your return.

My Thoughts:

There’s no denying that handing your taxes over to a trusted expert – especially while juggling the stresses of work and home life – is a splendid solution for many busy parents. Here’s why I feel an investment in TurboTax Live Full Service is a sound one:

Dedicated Expert. Once you connect to a TurboTax expert, they will be your dedicated representative from start to finish. You can chat with them as many times as you need to – on your own time.

Maximum Refund Guarantee. If you get a larger refund or smaller tax due from another tax preparation method, you will receive a refund of the TurboTax purchase price.

CRA Liaison. If the government requires more information, or has questions about your return, your tax expert will liaise on your behalf, which can save both your time and sanity.

Audit Defence. In the case of an audit, TurboTax will represent you and defend your tax return to the CRA. Audit Defence (usually an add-on service priced at $39.99) is included with TurboTax Live Full Service at no additional cost.

Connect Seamlessly. Whether you’re filing from a mobile phone (iOS/Android), tablet (iOS/Android) or computer, you can seamlessly start, stop and continue your taxes across devices.

Need a little lift this tax season? Whether you’re self-employed or a regular tax paying individual, TurboTax Live Full Service has real experts to help understand your unique tax situation – getting your maximum refund, guaranteed.

This post is sponsored by TurboTax Canada. The opinions on this blog, as always, are my own.

Leave a Reply