Happy 2020, friends!

We’re just a few weeks into the new year and I’m already feeling amazing about my progress. This year, I decided to shun resolutions and instead set goals for improvement that I’m willing to continuously work on. My plan to better nutritional, physical and financial health in 2020 includes:

1) Make better food choices for my family. This includes adopting a more plant-based lifestyle, reducing the amount of processed foods in our diet and making healthier substitutions when possible. It’s definitely a work in progress for me, but this year I’ve communicated my plan to everyone in the family and, so far, have buy-in. Fingers crossed!

2) Get physical, together. Although our family is moderately active, I realized last year that we don’t actually spend time together enjoying physical activities. This year, we’ll be skiing, canoeing, bike riding and ice skating as a family. Our days are busy, so I’m hoping to make this one work!

3) Focus on building the boys’ RESPs. It feels like I blinked and suddenly, my sons will be 12 and 10 years old! Although I created an RESP for each of them many years ago, I’ll admit that I’ve majorly slacked when it comes to contributions.

3) Focus on building the boys’ RESPs. It feels like I blinked and suddenly, my sons will be 12 and 10 years old! Although I created an RESP for each of them many years ago, I’ll admit that I’ve majorly slacked when it comes to contributions.

(I have an excuse ready, of course.) It’s just that year after year, there’s always a project or expense that I tend to prioritize. At the time, it feels like the right move – until the end of year when I notice we’re no further ahead with saving for our children’s post-secondary education.

After all, today it’s BEDMAS… tomorrow, it’s an actual bed. In a dorm room. Coupled with the time it takes to find an available appointment with my financial planner, understand my investment strategy and find available funds to set aside… let’s just say that I need to find a simpler way to stay on track.

Coupled with the time it takes to find an available appointment with my financial planner, understand my investment strategy and find available funds to set aside… let’s just say that I need to find a simpler way to stay on track.

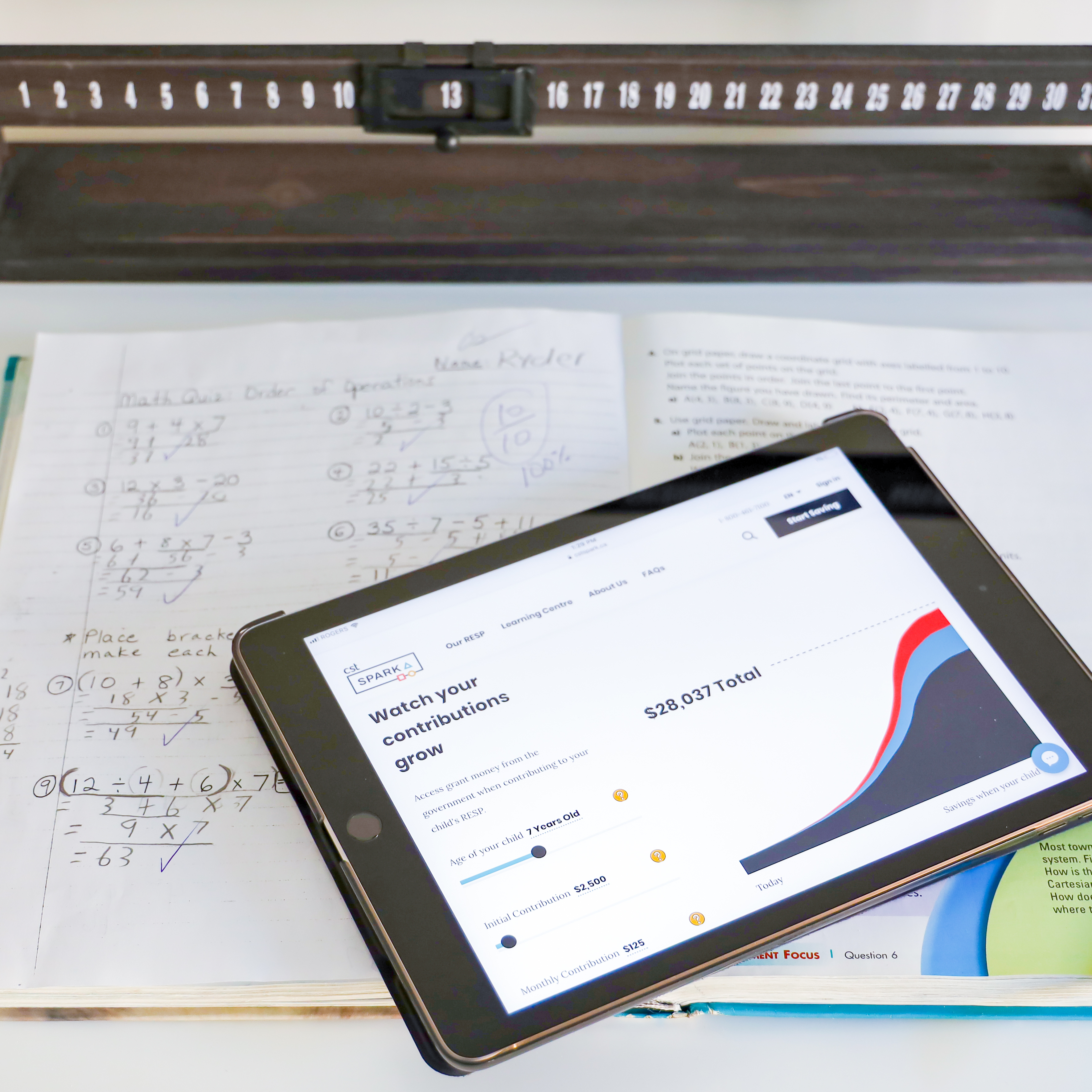

Thankfully, I was recently introduced to CST Spark, the newest member of the Canadian Scholarship Trust Foundation (CST) family. With Bright Plan, a flexible Registered Education Savings Plan (RESP), it’s easier than ever for Canadian families to achieve their education savings goals through easy-to-use technology on their digital devices, at any time.

Here’s what sets Bright Plan apart from other RESPs:

1) It’s the modern way to save for your child’s education. You can initiate and oversee the entire investment process online, which is especially important with today’s hectic family schedules. That means you can skip the bank and access your Bright Plan safely from your laptop, tablet or phone. The plan invests in a mix of exchange-traded funds (ETFs) that are professionally managed by experienced investment leaders.

And, if you have questions along the way, CST Spark’s Direct Dealing Representatives are available to provide guidance and assistance.

2) CST Spark’s Bright Plan offers unparalleled flexibility. You can control how much and how often to invest – even as little as $10 a month. What’s unique to Bright Plan is that your investment is rebalanced as your child ages with the goal of maximizing growth early (with equities) and preserving your gains closer to graduation (with fixed income securities). And if you change your mind? No worries, you’ll get all your contributions back within the first 60 days.

2) CST Spark’s Bright Plan offers unparalleled flexibility. You can control how much and how often to invest – even as little as $10 a month. What’s unique to Bright Plan is that your investment is rebalanced as your child ages with the goal of maximizing growth early (with equities) and preserving your gains closer to graduation (with fixed income securities). And if you change your mind? No worries, you’ll get all your contributions back within the first 60 days.

I wanted to pause for a moment to underscore that you can invest as little as $10 per month – the price of two lattes. One of the reasons that I’ve had such a poor record with investing in RESPs is the false belief that I need to have a sizeable portion of funds to set aside each month. Not true! Every little bit counts and if you’re looking for a flexible way to start saving, Bright Plan is for you.

3) The Canadian Scholarship Trust Foundation (CST) was the creator of education savings plans in Canada. Over 570,000 Canadian families have put their faith in CST with their education savings; in fact, CST was the first to lobby for education savings plans in Canada. Therefore, you can feel confident that CST will take care of your plan, and help you achieve your savings goals for your child’s future education.

If you’d like to learn more about CST Spark’s Bright Plan, I’d love to suggest the following:

If you’d like to learn more about CST Spark’s Bright Plan, I’d love to suggest the following:

– Visit www.cstspark.ca and use the online savings calculator. It’s a great place to start if you’re not sure how much you’ll need to invest monthly.

– Schedule a free consultation with a CST Spark Direct Dealing Representative online. You’re under no obligation to purchase and knowledge is power!

– Check out the Learning Centre. Here you’ll find out how RESP’s work and find links to helpful FAQs.

If 2020 is the year that you make looking after your nutritional, physical and financial health a priority, high five! I’m right there with you, and enjoy the camaraderie that comes with working towards a common goal. Let’s check in on one another from time to time, deal?

This post is sponsored by CST Spark. The opinions on this blog, as always, are my own.

Leave a Reply