If you started a small business during the past two years, you’re in great company! Two million Canadian entrepreneurs – including a large percentage of “mompreneurs” – created businesses during COVID-19. Whether you’ve registered your interior design company, launched a home-based bakery, curated a social media following or (insert dream job here), moms are wearing more hats than ever and side hustles have been pushed into the spotlight.

As a business owner myself, I can say that the rewards are well worth the risk! However, I will add the following caveat: no one prepared me for the sheer amount of paperwork that comes with being your own boss. From invoices (incoming and outgoing) to contracts to every possible .docx file in between, I spend a lot of time managing the least fun part of my business. And now that we’re in the middle of tax season… ugh.

I know that many new mompreneurs are in the same boat. Especially if this is your first or second year identifying as self-employed (congratulations on officially elevating your side hustle to replace your full-time income!), you may not have the time or expertise to ensure you’re taking advantage of every tax credit, tax strategy or tax savings available to you. Listen, I get it! The thing about passion projects is that it’s easy to focus on what drives you, and usually, that doesn’t include calculating the depreciation on the car you use to drop off your homemade welcome mats.

I know that many new mompreneurs are in the same boat. Especially if this is your first or second year identifying as self-employed (congratulations on officially elevating your side hustle to replace your full-time income!), you may not have the time or expertise to ensure you’re taking advantage of every tax credit, tax strategy or tax savings available to you. Listen, I get it! The thing about passion projects is that it’s easy to focus on what drives you, and usually, that doesn’t include calculating the depreciation on the car you use to drop off your homemade welcome mats.

But… the tax deadline is approaching! The self-employed tax filing deadline for Canadians is June 15. However, if you owe money to the Canada Revenue Agency (CRA), that amount is still due by May 2nd – despite the mid-June filing deadline. Courtesy of TurboTax, Canada’s #1 tax software, here are some handy tips for self-employed filers:

1. Get Organized Now! In addition to your usual tax receipts – such as T4s, childcare, investments, etc. – you’ll also need to collect the receipts for your business.

Not sure what to include? TurboTax has a great Self-Employed Checklist which you can download and use year after year. Pay particular attention to “Business Use-of-Home Expenses” – there are several items included that you may have overlooked, like cleaning costs or strata fees!

2. Know What You Can Claim. Tackling your taxes on your own? Cool, cool – but with TurboTax, you’re never really alone. TurboTax has over 400 tax credits and tax deductions built into its software, with excellent prompts for the self-filer. As you work through your tax return, the software guides you towards deductions that you might be able to claim, which means more money back in your pocket to pursue what you love. Get every dollar you deserve!

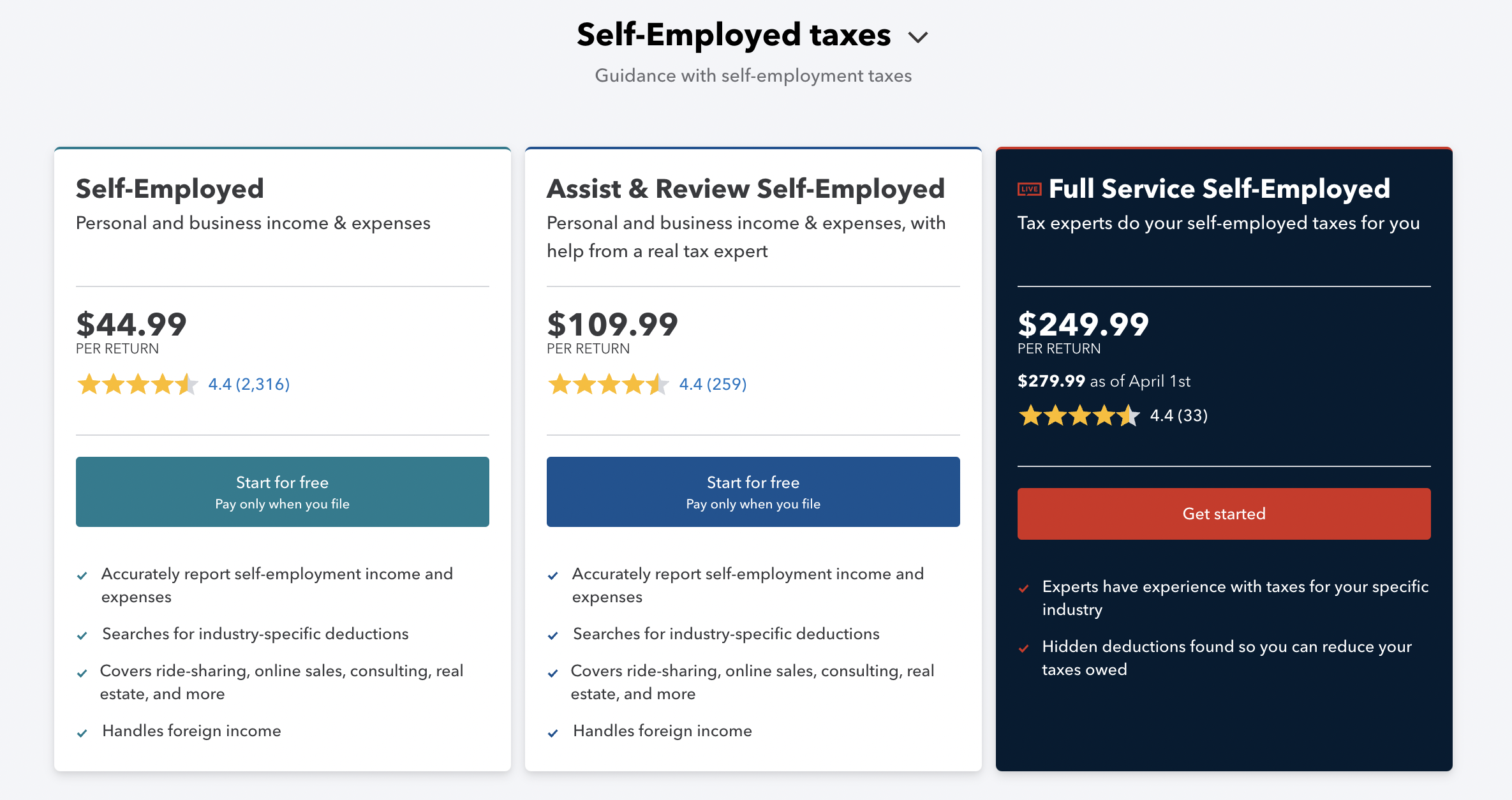

3. Use Technology to Your Advantage. If we refer to the aforementioned desire to unload paperwork (especially the unfun kind) on an expert, there are two TurboTax Self-Employed products for you to choose from: TurboTax Self-Employed Assist & Review, and my pick for mompreneurs: TurboTax Live Full Service Self Employed. Here’s how it can save you time and money:

3. Use Technology to Your Advantage. If we refer to the aforementioned desire to unload paperwork (especially the unfun kind) on an expert, there are two TurboTax Self-Employed products for you to choose from: TurboTax Self-Employed Assist & Review, and my pick for mompreneurs: TurboTax Live Full Service Self Employed. Here’s how it can save you time and money:

1. This is a white glove service. With TurboTax Live Full Service Self-Employed, a TurboTax expert who knows everything about filing a self-employed income tax return accurately will do your taxes for you. Plus, if you are registered for GST/HST, they’ll handle that return for you as well at no extra cost.

2. You can schedule time to connect with a tax expert at a time that suits you. Did I mention it’s from the comfort of your own home? Simply set up a phone call or one-way video call (you can see them, but they can’t see you) to review your tax documents before filing. The best part? No question is off limits, and you’ll have an expert with 10+ years’ experience working on your file.

3. If the government requires more information, or has questions about your return, your tax expert will liaise on your behalf, which can save both your time and sanity. In the case of an audit, TurboTax will represent you and defend your tax return to the CRA. Audit Defence (usually an add-on service priced at $49.99) is included with TurboTax Live Full Service Self-Employed at no additional cost.

We know that running a small business is hard work. Focus on doing what you love and let TurboTax handle your tax return. The cost for TurboTax Live Full Service Self-Employed is just $249.99 (after April 1st, $279.99) – well in line (or less than) what you would pay for a traditional accountant, while completing your taxes on your schedule from the comfort of your home. And remember, this service is a claimable tax expense!

You can always rely on TurboTax to:

– Listen to understand your unique situation

– Answer your questions

– Give you unlimited tax advice

– Help you get your biggest possible tax refund

Click here for more information on TurboTax Live Full Service Self-Employed.

From one mompreneur to another, I wish you booming business, net 30 receivables and a happy TY21 tax return!

This post is sponsored by TurboTax Canada. The opinions on this blog, as always, are my own.

Leave a Reply